KUALA LUMPUR, Feb 14 — Have you ever tried reading your medical insurance policy? Or do you just forget about it until you need to make a claim?

Or maybe you are overwhelmed by all the jargon, but would really want to compare different policies and buy the best medical insurance plan based on your needs and budget?

Here are nine basic medical insurance terms, based on the government-backed Financial Education Network’s (FEN) guide, and also online guides by Malaysia’s insurance and takaful industry.

Test yourself or use this as a refresher:

Annual limit

This is the maximum amount that your insurance company will pay for your hospital bills in a year.

For example, if your annual limit is RM100,000, but the hospital bill is RM150,000:

Your insurance will only pay for RM100,000, and you have to pay RM50,000 from your own pocket.

Since it is an annual limit, this limit will be refreshed the next policy year.

(For example, if your policy year starts on May 1, 2025, it will end on April 30, 2026. This means that you will have a fresh RM100,000 annual limit from May 1, 2026.)

It can be tempting to buy medical insurance with bigger annual limits (that even go up to millions in ringgit), but the monthly premiums you have to pay to keep the insurance going will be more expensive too, so check your budget and expected medical needs.

Lifetime limit

For example, if your insurance’s lifetime limit is RM500,000, and you have claimed for hospital bills worth RM500,000, that means you have reached the limit.

Your medical insurance’s coverage will end, and you cannot use this insurance anymore, and you have to buy new medical insurance.

Note: Not all medical insurance plans have a lifetime limit.

Guaranteed yearly renewal OR 4.Non-guaranteed renewal

While medical insurance with non-guaranteed renewal typically has cheaper premiums, insurance companies can decide not to renew your policy, for example if you now have an illness that is likely to come back in the future.

So you now have to buy new medical insurance, and you will have to declare your illness as a pre-existing medical condition.

This could lead to insurance companies charging you a higher premium for your new insurance, or insurance companies could even sell you the new insurance but decide not to cover this illness.

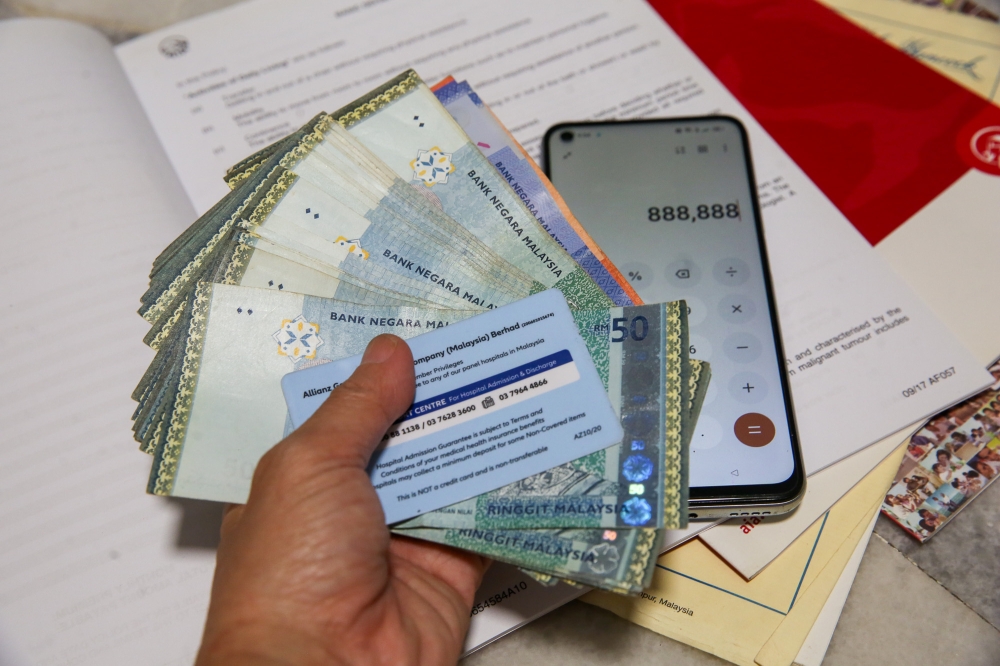

Look at what you need and what you can afford when buying medical insurance. — Picture by Choo Choy May

Standalone OR 6. Rider

A “rider” is just a fancy name for anything you choose to add on to an insurance policy, and you will usually have to pay more for riders.

For example, if you buy life insurance and add on medical insurance as a “rider”, this insurance will not only pay out money in case of your death, but will also pay for your hospital bills.

Free-look period

During this period, you will be able to cancel your insurance policy and get a refund of the premium you have paid.

This tends to be within the 15 days after your insurance policy is issued (but do check your insurance policy’s conditions).

Waiting period

After you buy medical insurance or reinstate your insurance, you will have to wait before you can make claims for hospital bills.

(Usually you cannot claim within the first 30 days of your insurance, but check your policy’s conditions).

Usually there is an even longer waiting period of 120 days for “specified illnesses”, which is a list of illnesses that you cannot claim for during the first 120 days (e.g. diabetes, hypertension, tumours, cardiovascular diseases), but again check the policy’s conditions.

You should also check out the “exclusions” section in your insurance policy, which lists what it will never cover, such as medical conditions that already existed at the time of birth.

Grace period

If it is time for you to pay your premium but you have not paid it yet, you can still pay within the “grace period” without being charged a penalty.

Your insurance coverage will also remain active during this grace period.

This is just a guide to help you understand your insurance policy better, and you should get professional advice from an insurance agent.

Just like how you can check official online registries for if someone is a practising lawyer or a registered specialist doctor in Malaysia, you can also check if your insurance agent is registered on any of these three databases:

• Life Insurance Association of Malaysia (LIAM)

• General Insurance Association of Malaysia (PIAM)

• Malaysian Takaful Association (MTA)