JUNE 30 — On July 1, 2025, Malaysians will begin paying more for a range of services as the government raises the Sales and Service Tax (SST) from 6 per cent to 8 per cent.

Framed as part of the Madani Government’s broader fiscal reform efforts, this move is projected to generate an additional RM3 billion annually.

However, a deeper look reveals that this is less about meaningful reform and more about plugging short-term fiscal gaps. The SST hike may be the most visible tax adjustment since the Goods and Services Tax (GST) was repealed in 2018, but it is not a structural solution to Malaysia’s longstanding fiscal challenges.

The government justifies the increase by pointing to Malaysia’s low tax-to-GDP ratio — about 11.8 per cent compared to Thailand’s 16 per cent or Vietnam’s 19 per cent — and its need to diversify revenue away from volatile petroleum sources.

But the SST, by design, is narrow in scope, non-transparent, and prone to inefficiencies.

Unlike the GST, which taxed consumption broadly with built-in mechanisms for input tax credits, the SST is a single-stage tax. This results in cascading effects, where businesses simply pass the hidden costs down the supply chain, ultimately inflating prices for consumers.

Because the SST only applies to selected goods and services, a large portion of the economy remains untaxed. In an economy where the informal and shadow sectors are growing, this limited coverage raises questions about fairness and effectiveness.

Many economists agree that Malaysia had a better system with GST, abandoned not because it failed in principle, but because it was poorly implemented.

The GST was broad-based, efficient, and allowed for more accurate tracking of economic activity. Its input credit mechanism prevented tax-on-tax effects, and it aligned with international best practices.

What it lacked was political and operational maturity: it was rolled out without strong public communication, and it was not paired with sufficient protections for lower- and middle-income households.

Instead of fixing these shortcomings, the government of the day chose to scrap it entirely. Now, we are left with a weaker alternative that raises revenue less equitably.

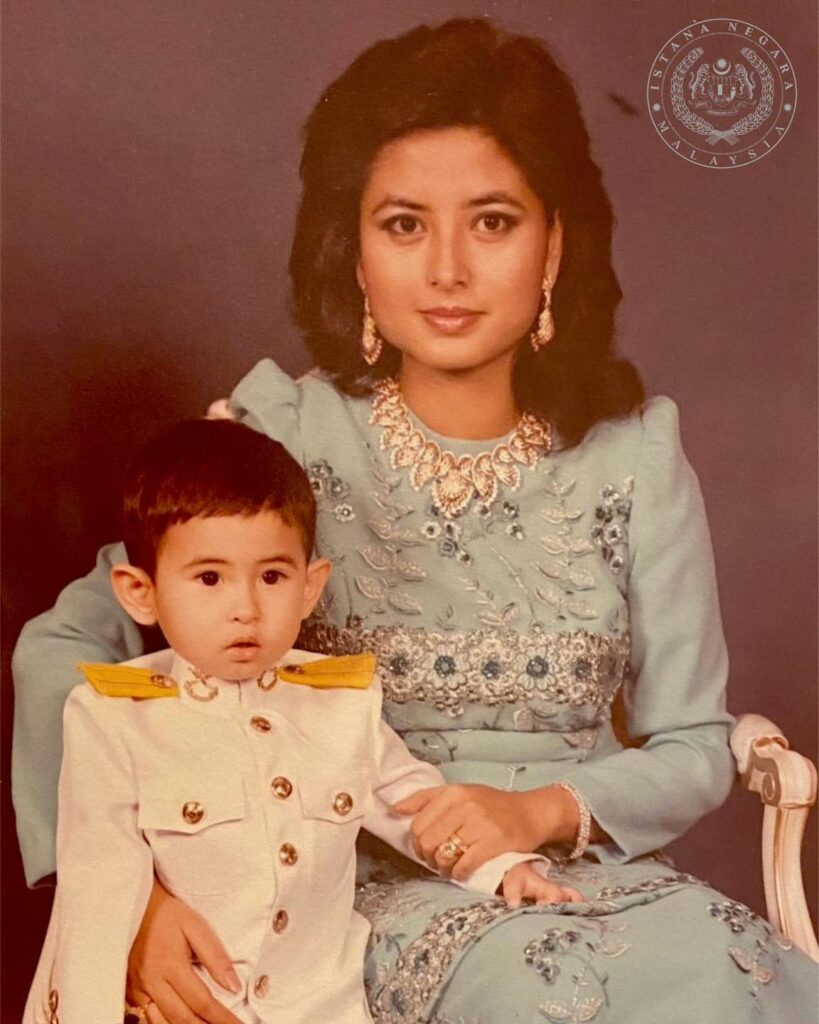

The Ministry of Finance has clarified that agricultural produce grown in Malaysia are not subject to sales tax under the expanded Sales and Service Tax. — Bernama pic

The current administration has signalled that more tax changes are coming, including new luxury taxes and further subsidy rationalisation.

But so far, these announcements have been scattered and lack a clear, time-bound roadmap. What Malaysia urgently needs is not just higher taxes, but a comprehensive and transparent fiscal reform strategy.

The government should publicly commit to a timeline for phasing out blanket fuel and electricity subsidies, expanding targeted assistance, reforming income tax structures, and, if needed, reintroducing the GST in a way that is progressive and fair.

Without these steps, Malaysia risks falling into a cycle of temporary fixes and long-term stagnation.

The people of Malaysia are not resistant to reform. What they resist is uncertainty and the feeling that they are being asked to pay more without knowing where the money is going or how it will improve their lives.

Fiscal responsibility is not simply about collecting more money from the public — it is about governing more transparently, spending more effectively, and building trust.

The SST hike, taking effect on July 1, may raise revenue in the short term, but it does not constitute real reform.

Without a transparent plan, bold political leadership, and clear accountability, the government risks losing the very trust it needs to implement future reforms.

If the government is truly serious about building a sustainable, inclusive economy, it must stop relying on patchwork fixes.

Malaysia cannot afford to raise taxes without also tackling leakages, rationalising subsidies, and laying down a concrete roadmap for structural change.

The rakyat deserves more than ad hoc policies. They deserve a government with a long-term vision, the courage to make tough decisions, and the discipline to follow through.

* Tan Wei Siang writes on economic policy, structural reform, and Malaysia’s development agenda. He believes in honest governance, equitable growth, and long-term nation-building.

** This is the personal opinion of the writer or publication and does not necessarily represent the views of Malay Mail.