KUALA LUMPUR, Feb 15 — Are you feeling unsure about whether your medical insurance will cover your private hospital bill, or wondering how to make medical insurance claims?

Here is a quick list of seven basic steps that you need to know, based on the government-backed Financial Education Network’s (FEN) MHIT Made Simple guide and online resources by Malaysia’s insurance and takaful industry:

1. But first, what to confirm before you undergo medical treatment?

Ask your doctor, insurance company or insurance agent if your insurance covers this treatment, especially if it is a newer or uncommon treatment.

Ask your doctor:

• If this treatment is medically necessary;

• If you need to stay at the hospital, or if there is an outpatient or day surgery alternative (which would usually be cheaper);

• If there are other treatment options (for example, if you expect difficulties paying for this yourself from your savings).

2. Who pays for what in a hospital bill?

Just be aware that having medical insurance does not mean you do not have to pay anything at all for hospital expenses.

So make sure to check your hospital bill carefully.

You should not pay for non-claimable items in the hospital bill, unless these are for procedures that you had agreed to.

3. Is it ‘cashless’ or ‘pay first, claim later’?

4. How to avoid unnecessary delays when making medical insurance claims?

Keep all receipts before and after your hospitalisation, and make sure the bills are itemised and dated.

Ask your doctor or specialist to fill in and sign your claim form.

When submitting your claim, make sure you give all the supporting documents (e.g. original bills and receipts, full doctor’s reports, cost summary of treatment, referral letter, medical reports, proof of treatment).

Make sure to submit your claim as soon as possible, and track your claims status.

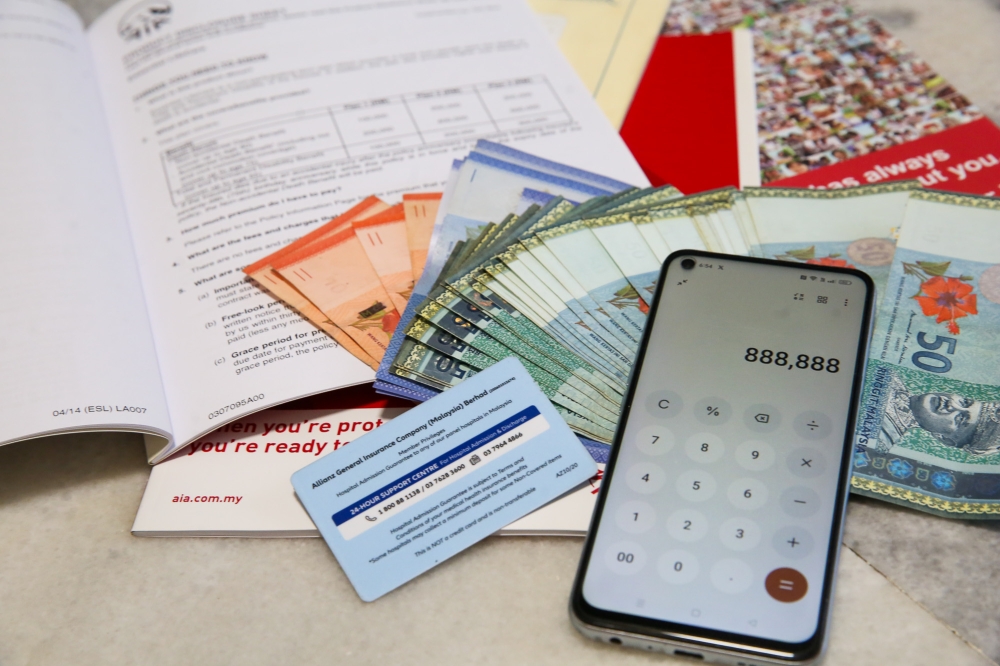

Read your medical insurance plan’s product disclosure sheet and also the insurance policy carefully, and consider if you can still afford medical treatment at a hospital if not covered by insurance. — Picture by Choo Choy May

5. Why is the insurance company saying no to your hospital bill?

Check your medical insurance policy, as it is common for insurers to exclude or to not cover certain conditions, such as conditions that existed at the time of your birth.

If you already know that your medical insurance will not cover a medical procedure or condition, you can consider other choices: For example, going to a private hospital which charges you less, or going to a government hospital.

6. What can you do to avoid rejection of your medical insurance claim?

If you have pre-existing medical conditions, make sure you disclose this to the insurance company when you are buying medical insurance.

That is how you can reduce the risk of rejection of your claim.

After you disclose your pre-existing condition, the insurance company can:

a) decide to not sell you any medical insurance at all; or

b) sell you medical insurance but not cover medical bills for your pre-existing condition; or

c) accept the risk and sell your medical insurance that covers your pre-existing condition.

7. What can you do if your medical claim is delayed/ disputed/ rejected?

A. Go to your insurance or takaful company first

You can ask your insurer or agent to clarify.

You or your agent can appeal; or you can file a complaint with your insurer’s Complaints Unit.

Here is Bank Negara Malaysia’s full list of the Complaints Unit of each insurer (Filter it by selecting “Insurance companies” or “Takaful operators”, then click on your insurance company’s name to get the Complaints Unit’s details):

B. If it’s not resolved, go to FMOS or BNM

If you are not satisfied with the insurer’s response and cannot resolve the issue, you can contact the Financial Markets Ombudsman Service (FMOS).

FMOS is an independent body that can help you resolve your dispute for free outside of court, without you having to hire a lawyer or to go through a lengthy and costlier process at court.

Alternatively, you can refer your case to BNM’s BNMLINK.

But do note that BNM will not accept cases that have not been referred to the insurer’s Complaints Unit, and will also not accept cases that have been referred to FMOS, the courts or tribunals.

You can check out the MHIT Made Simple guide: https://www.fenetwork.my/medical-and-health-insurance-takaful/

You can also check out the local industry and takaful industry’s medical insurance guides, including this one: https://www.liam.org.my/pdf/consumer/Infographic-02.pdf